In early 2000s, when e-readers such as Amazon Kindle started gaining popularity, it was supposed that the rise of these devices marked the death of print books and independent bookstores in the future.

And when in 2011, Borders declared bankruptcy, the book world was seized by collective panic over the uncertain future of print.

But contrary to those predictions, printed books have proven to be resilient and have managed to adapt to the changing landscape of the publishing industry. While e-readers and digital platforms have undoubtedly impacted the way we read and access books, the dreaded digital apocalypse never arrived.

Or at least not yet and if the market forecasts being made from different sources are to be believed, printed books will continue to coexist with their digital avatar.

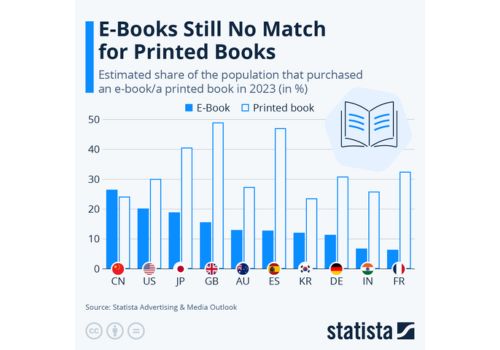

For data from Statista’s Market Insights: Media & Advertising’s 2023 report reveals that printed books continue to have a larger market share compared to e-books in most countries worldwide.

For instance, in the United States, approximately 30 percent of the population purchased a printed book last year, whereas only 20 percent bought an e-book.

Global book market share

It was only in China, the trend differs, with around 27 percent of people purchasing an e-book in the 12 months prior to the survey, while only 24 percent bought a printed book during the same timeframe.

Let’s delve into the revenue projections and growth trends in the physical books market.

Global Book Market Size by Format

Global book market size by format

The demand for physical books is projected to be remains steady. While ebooks and audiobooks have gained traction in recent years, particularly among tech-savvy readers, the larger market share of hardcopy books underscores their continued relevance.

Revenue in the Physical Books Market

The physical books market is projected to generate significant revenue, with an estimated US$69.44 billion in revenue in 2024. This figure indicates the market’s strength and the continued demand for physical books, despite the rise of e-books and digital platforms.

The United States is expected to generate the most revenue in the global physical books market, with an estimated US$14,650.00 million in 2024.

Projected Growth and Market Volume

The physical books market is expected to grow at a moderate pace, with an annual growth rate of 0.37% between 2024 and 2029. This growth rate is relatively low compared to other markets, but it still indicates a steady demand for physical books. By 2029, the market is projected to reach a volume of US$70.75 billion, which is a significant figure considering the market’s size.

Reader Base and User Penetration

The physical books market is expected to have a large user base, with an estimated 1.9 billion users by 2029. This figure indicates the market’s reach and the wide appeal of physical books among readers.

Czechia has the highest user penetration rate in the physical books market, with an estimated 52.2% of the population expected to be users by 2029.

Global Revenue Distribution

Global revenue distribution

The North America books market made the largest contribution to the global market, with a revenue share of over 33% in 2023. The presence of a large number of independent publishers and publishing companies in the region is anticipated to boost market growth.

The Asia Pacific books market is expected to grow at a CAGR of 2.4% from 2024 to 2030. The Asia Pacific market for books is currently in the growth phase. The region is dominated by local publishers, and the demand for international books is anticipated to increase.

However, many diverse languages are prevalent in this region, and thus, the demand for books in regional languages is higher compared to English books.

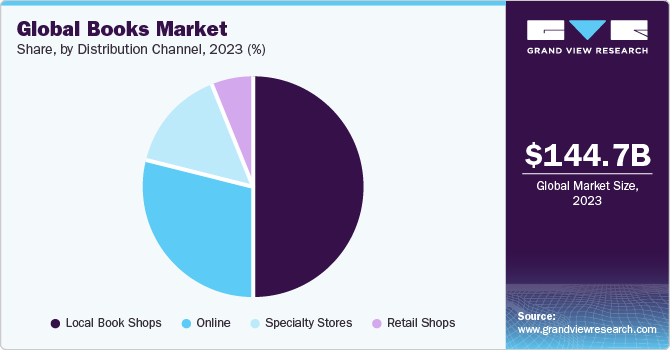

Global Market Share by Distribution Channels

Global book market share by distribution channels

in 2023, local bookshops held the largest market share, indicating the continued importance of physical bookstores in the industry. Online platforms, such as e-commerce giants like Amazon and online bookstores, held the second-largest market share followed by retail outlets.

Growth Drivers

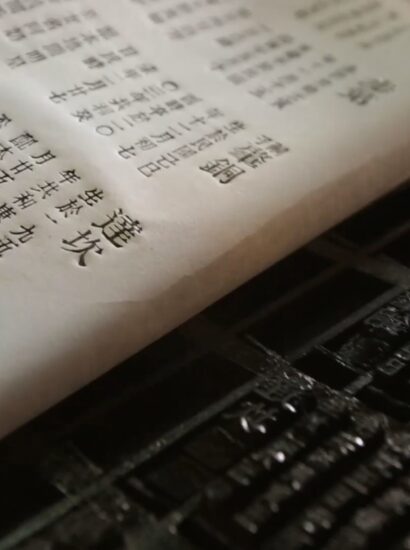

The growing preference for offset printers and the rise in adoption of small and large-scale digital printing capabilities is expected to transform the market over the next few years.

The rising trend of demand for shorter run printing jobs, fueled by increasing self-publishing and print-on-demand orders will create lucrative opportunities for leading vendors operating in the market.

The global book printing market is driven by business consolidation and the rising number of self-publishing opportunities. The introduction and adoption of digital printing capabilities will revolutionize the global market over the next few years.

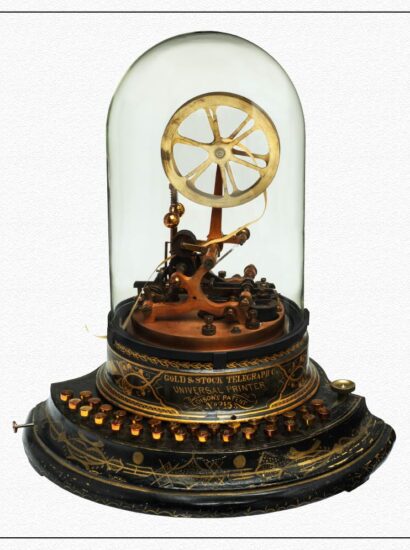

The online commerce platforms are presenting opportunities to both direct and indirect clientele of book printing. The clients include publishers, authors, and agents who utilize online platforms to place their orders to book publishers and manufacturers. Such developments in the marketplace are allowing the book publishers and traders to expand their clientele from large corporates to an increased number of small and individual customers.

Key Companies & Market Share Insights

The books market is characterized by the presence of several well-established players such as Penguin Random House, Hachette Book Group, HarperCollins, Simon & Schuster, Macmillan, and Pearson. These players account for a considerable market share, have diverse product portfolios, and a strong presence across the globe. Moreover, the books market also includes small to mid-sized players, who offer a selected range of products; of these, some are self-publishing companies.

Key Players:

Penguin Random House

Hachette Book Group

HarperCollins Publishers

Simon & Schuster, Inc.

Pearson

Macmillan Publishers

Scholastic Inc.

Marvel Comics

Morris Publishing

IDW Publishing

Machine Dalal platform is preferred by buyers and sellers from the global print industry to get directly connected with each other and trade their machinery.

Visit the Machine Dalal website or simply download our app onto your Android or iOS smartphone.